Welcome to the UK, home to the city of London, one of the world’s most vibrant and multicultural cities, with people from all around the world and over 100 languages spoken, there is plenty to discover, whether it be places, food or entertainment.

Before you journey out exploring London and the other vibrant cities of UK, you need to have a few things ticked off from your to-do list like opening a UK bank account.

It was once difficult to open a bank account when recently arriving in the UK. However, things have changed now with the process becoming slightly easier.

Let’s have a look at how to open a bank account:

There are numerous banks which will allow you to open a basic bank account, which does exactly what it says on the tin. It is free to open and provides easy access to banking facilities in the UK, including depositing and withdrawing funds, setting up standing orders for bill payments and use of a debit card. It is very unlikely that you would be offered credit by way of an overdraft. Most banks will not require you to deposit money to open a bank account and you should try and visit one of the local branches where you live to check out their offers.

You can withdraw money from your account using your debit card at almost any ATM throughout the country. You can also make such withdrawals at the Post Office or request cashback* at supermarkets. New Debit cards now use touchless technology which allows you to “tap” your card at any “touchless” card readers for payments up to 20 pounds. You can also use these on London public transport to pay your fare just as you would use an oyster card. Before you wonder off bank account shopping, make sure you have the required documents to open the bank account, which will save you making another trip.

What documents do you need?

- Your passport and student visa or your National Photo IdentityCard if you are a European student.

- A letter from your educational institution confirming details of your studies in the UK or a letter of Introduction to be completed by your educational institution.

Remember to keep your bank updated whenever you change address!

Other types of accounts might be available, which might be tailored around your requirements, as an International student or otherwise. A small charge might apply to such accounts and it is always worth checking.

Confused?

*Cashback – is a service offered by some businesses where you can request cash back (pretty clever huh) when you pay for your purchases by card.

If your application to open a basic bank account is refused, you are entitled to ask why. For further help, do consult your student services centre. Also, British Bankers’ Association is a good source to refer to know what services you can get with a bank account.

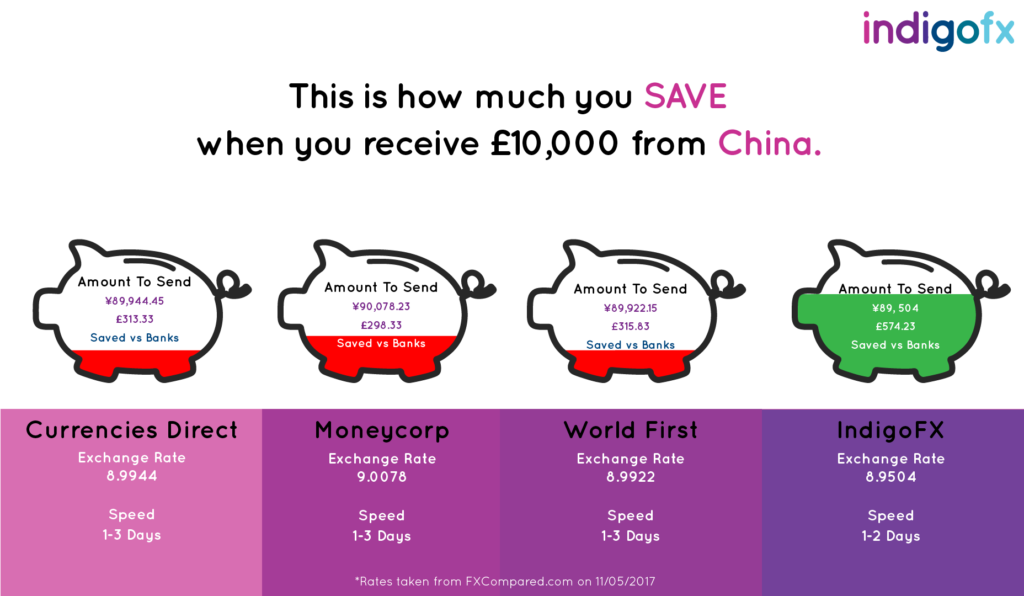

Now that you know the steps to opening your UK bank account, you must be looking to make and receive international payments via your bank. Well, you may want to have a second thought about this. You might lose money to fluctuating exchange rates, expensive transaction fees and other unforeseen charges from the banks.

Using Indigo FX for your international payments will help you save more money. Your payments will be quickly processed, you won’t have to lose your money to the monstrous fees set by the banks. And to top it all off, we strive to provide you market-leading rates.

The image below allows you to compare our rates to those of the high-street banks and other brokers.

Good luck opening your bank account!