Tomorrow will be a big day in the UK politics.

Think that Jeremy Corbyn as Prime Minister is never going to happen?

Don’t be so SURE!

What, Another drop in the Pound?

Yes. A Labour victory would result in a decline in the value of the Pound.

Will the Pound witness another flash crash?

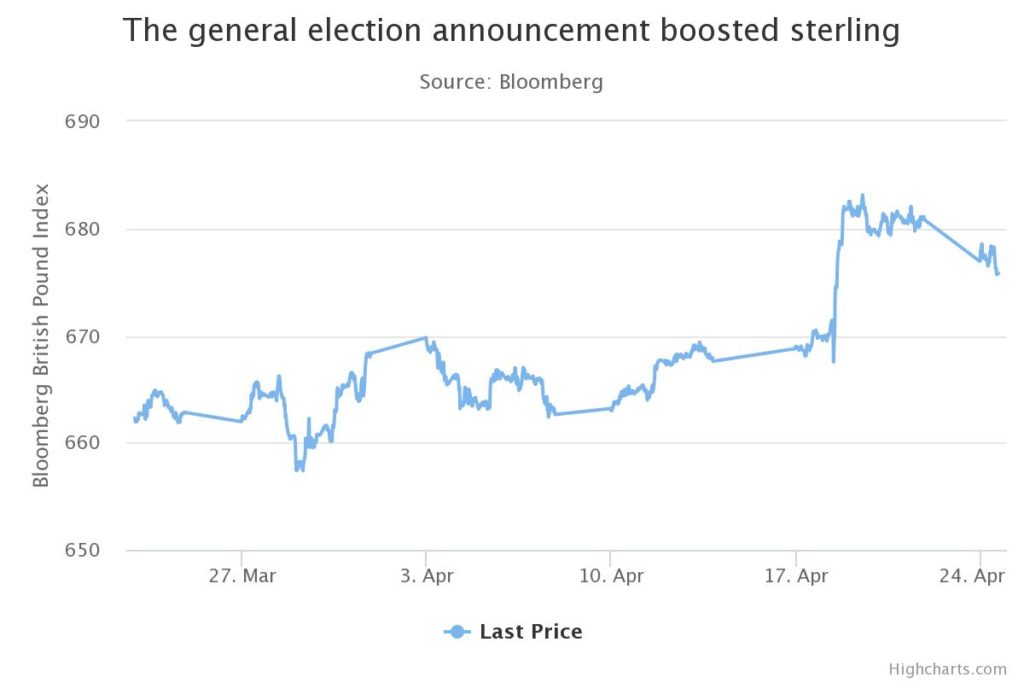

The Pound has dominated economic headlines this year. However, since Brexit, economists across the country have mainly expressed their doubts about the currency. Since the referendum last year, the Pound has depreciated t0 31 year lows against the Euro. A weak pound means households will suffer from rising inflation and damage growth forecasts. As with all currencies, the Pound’s value is currently driven by political concerns at home. The Brexit vote last year, Prime Minister Theresa May’s speech and the snap General Elections have all had stern effects. Politics abroad have also influenced the currency markets, from the French Elections to President Donald Trump. Brexit, however, is the biggest subject facing the country for decades – but it has surprisingly not dominated the electoral conversation recently. Following the General Elections, the Pound’s prospects will be a key determinant if Labour wins as the party is mostly against a “hard Brexit.” Contrariwise, many political and economic experts think that Mr. Corbyn himself supported the decision to leave the EU – while a fair portion of Labour voters voted for Brexit.

At the time of writing, Labour has surged in the polls, closing the Conservative’s lead to as little as 1 point. So even though previously unthinkable, a Labour General Election victory seems possible. Before everyone starts getting excited, it is worth noting that Jeremy Corbyn’s personal approval ratings are still behind Prime Minister May and that Labour once had surging polls prior the 2015 elections.

So, the million-pound question remains, what would happen to the Pound if Labour were voted into power? Would it lead to a stronger currency?

The long-term future of this country’s relationship with the EU would be priority as officials in Brussels have confirmed that talks could be delayed allowing Mr. Corbyn more time to prepare. For now, a possible change in direction of Brexit negotiations is the source of uncertainty. There is no doubt this election offers voters a genuine chance to choose between two different views of how government should run. Unlike the Conservatives, Labour’s manifesto presents a big expansion in fiscal spending for investment and re-nationalising of major franchise company’s i.e. national rail. Access to foreign talent and investment would mean tax burdens for big corporations too.

So, would a boost in government spending shoot the Pound to a higher value?

Theoretically yes, but only once uncertainties i.e. Brexit pass. This would lead to investors moving money back into the sterling as they chase higher returns, and in fact – boost the currency. The short term, at least, would also see a lift in economic growth and productivity. If investors lose faith in the new government’s ability to pay its debts, there would be a significant break down in relationship – hence widening current account deficits (as the UK asks the rest of the world to fund its spending) and negatively affecting the pound.

Would a Hung Parliament mean a stronger Pound?

For Labour voters, the surge in polls is delightful news but in the grand scheme of things; this is the biggest concern as the possibilities of a hung Parliament hang. Uncertainty would see reluctance from overseas investors to commit cash to Britain. This is the worst of both worlds for markets as this would mean a world of unclear intentions and murky coalitions. The general compromise is that the narrower the polls get, the weaker the pound will get.

On a perhaps more positive side – a hung parliament would, at least by assumption, mean a softer Brexit should Labour win. This is particularly the case if they gain the support of the pro-European nationalists Liberal Democrats. This might be a good sign for the Pound… if, however, Mr. Corbyn was to push for policies such as higher corporate taxes, financial-transaction tax, nationalisation and taxes on executives, then the markets will be apprehensive. These are not the kind of policies that will encourage business to invest, or stay in a country locked in a Brexit negotiation ring.

How will all this impact your business?

Economists predict that a victory for the Tory will be supportive for the Pound. Senior analyst at Hargreaves Lansdown, Mr Khalaf, predicted that there would be a “small rise” in the value of the pound if Conservative Prime Minister Theresa May wins a majority. However, the risk is too big to take, especially in the light of what happened recently. The General Election is just 24 hours away and the tiniest change in sentiment can impact Sterling significantly. No one expected Brexit will happen, no one expected a Trump presidency! As much as Prime Minister Theresa May is expected to win when the results come in on Friday, Labour are now enjoying a lead in the polls, reducing the chances of Mrs May to stay in power.

While these are volatile times for financial markets, they need not be a risk for your business. Indigo FX can help you if you do not want to be affected by the swings in the currency fluctuations. There are several ways we can help you. We offer you exceptional service by providing you with a personal broker who will help you a hedging strategy to navigate those volatile times.

Worried about what will happen to the Pound on Friday? Why not lock it in now? With a Forward, the price we provide you with today will be the one you get when your payments are due. With rates fluctuating on a regular basis, a small variation in the rate could cost your business potentially thousands of pounds. A Forward Contract can help you eliminate the risk exposure associated with the General Election and protect your bottom line.

No one knows what will happen on Friday but Indigo FX will strive to enhance your margins and offer you market-leading rates for your daily FX transactions.