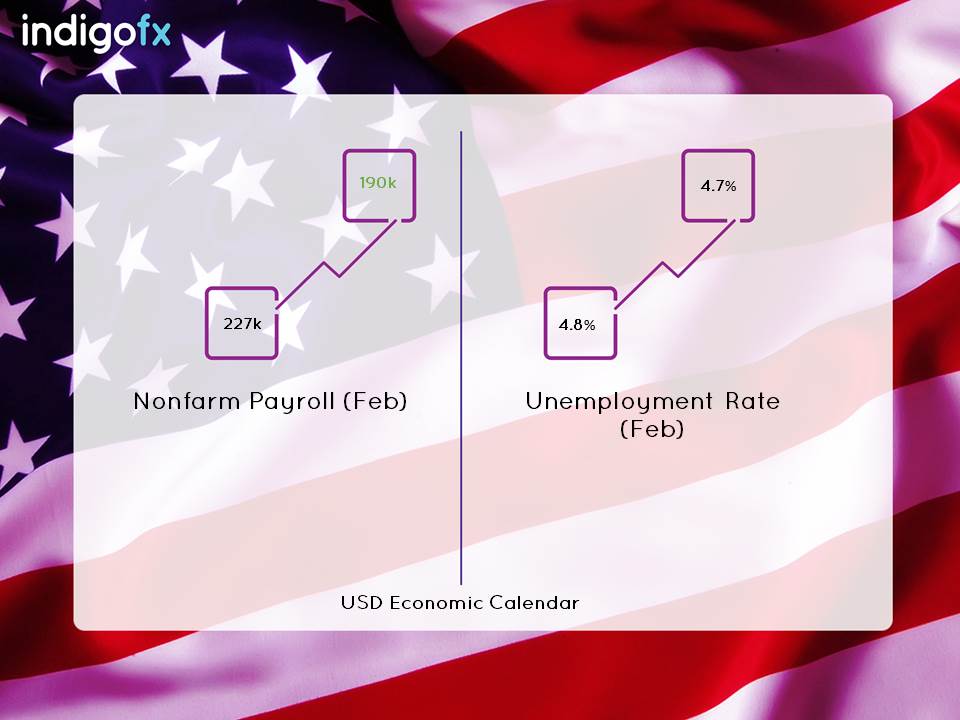

The ECB game is now over. The EUR/USD pair remained stable. However, there was a little peek in the pair as Draghi’s speech was more hawkish than expected. Today, it’s non-farm payroll day. Markets expect another 190k jobs to be added in February after having 227, 000 added in January. Unemployment rate is expected to fall from 4.8% to 4.7%.

Is a dollar rally expected?

Today’s non-farm payrolls is considered as the most important economic news of the week. It is not surprising that the markets are volatile since Trump’s inauguration ceremony. Key factors such as unrevealed tax plan, consecutive orders, Fed- White predicted house conflict and uncertainty surrounding European elections are causing market volatility. The Dollar remains on track with gains across the board. Investors are awaiting a strong jobs report that is extremely likely to be followed by an interest rate hike by the Federal Reserve next week. Added by a rather robust private jobs report from ADP the current expectations of a rate hike are at 89%. Only a huge drop in figures this afternoon could sway the Fed’s decision. Other price movement will then be governed by Chair Janet Yellen’s speech.

Get in touch if you have any upcoming EUR or USD requirements. The likeness of further Pound (GBP) losses are expected in the short/medium term.